End of Year Tax Planning for the individual

Income Tax

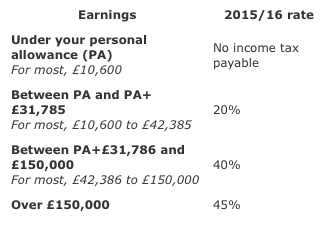

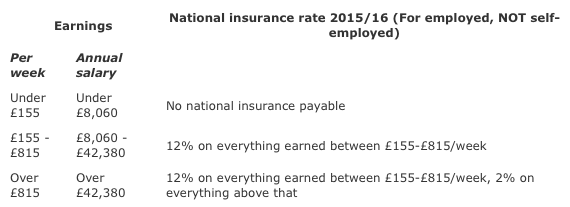

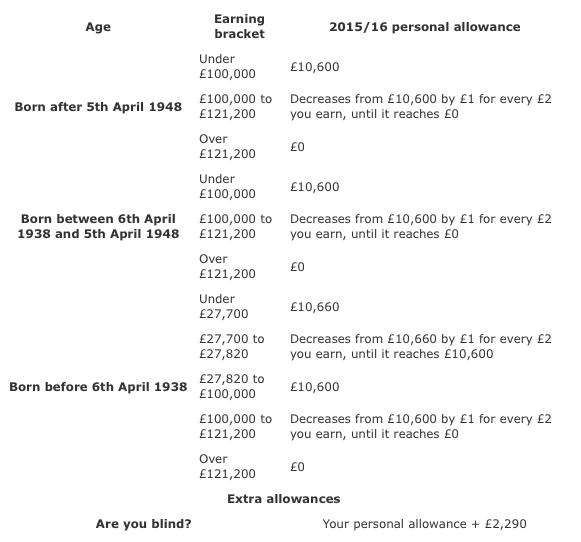

The starting point in tax planning is to understand where your income is likely to fall relative to the tax thresholds. For 2014/15, the tax free personal allowance is £10,000 and the next £31,865 is taxed at 20%. Higher rate tax of 40% is charged on income above £41,865 and additional rate tax of 45% is charged on income above £150,000.

The personal allowance is reduced by £1 for every £2 of income above £100,000. There is therefore no personal allowance at all where income exceeds £120,000. This also means that, over the income band £100,000 to £120,000, the effective rate of income tax is 60%. Or to put it another way, tax relief at 60% is available on pension contributions and Gift Aid payments in this income band.

To make the best use of tax allowances, sufficient income should be generated where possible to fully utilise the personal allowance and basic rate band. This may be done by careful planning of the timing of dividends from a private company or distributions from a family trust.

Married couples and civil partners have further opportunities for using their allowances and it should not be forgotten that children also have tax free allowances. It is also important to remember that child benefits get withdrawn by 1% for every £100 of income earned over £50,000 being reduced to nil once your income reaches £60,000. The effective rates can be over 70% in this band and can be mitigated by pension contributions and gift aid.

Action Point

Understand your income levels and the relevant bands during the year so you can have the choice to ensure your income does not fall within the bands if possible or to make pension contributions or gift aid payments to obtain better tax relief.

Seeking advice when preparing your tax return papers post the year end can usually be too late for the year already finished.

Capital Gains Tax

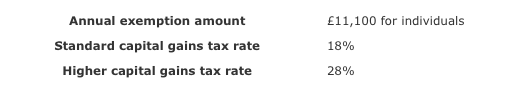

Use your Annual Exemption

The annual exemption for 2014/15 is £11,000. This is a ‘use it or lose it’ allowance; it cannot be carried forward to future years. It therefore makes sense to crystallise gains each year to the extent of the annual allowance, if possible.

Note that under the ‘bed and breakfasting’ rule, a gain does not crystallise for tax purposes if you sell shares and repurchase the same shares within 30 days. However, it is possible to repurchase the same shares through an ISA. Alternatively, a married couple can arrange for one partner to sell shares in the open market, and the other partner to buy the same number of shares.

Rates of Tax

The rate of Capital Gains Tax (CGT) is 18% where taxable gains plus taxable income are less than £31,865. Any excess is taxed at 28%. Where Entrepreneurs Relief applies, the rate is 10% (see below).

Crystallise and Use Capital Losses

Capital losses may be offset against capital gains in the same year. Unused losses may then be carried forward indefinitely and offset against future gains.

A formal claim is required. The claim must be submitted to HMRC within four years of the end of the tax year of the loss, otherwise it will be time-barred. Hence, claims must be made by 5 April 2015 in respect of 2010/11 losses, if claims have not already been filed.

When an asset becomes valueless or worth next to nothing, it is possible to make a “negligible value claim” in order to crystallise a capital loss. The claim can be related back up to two tax years in certain circumstances, allowing the loss to be offset against gains made in earlier years.

Can your capital gains qualify for Entrepreneurs Relief (ER)?

CGT is charged at 10% where ER applies, subject to a lifetime limit of gains totalling £10m.

ER applies to the sale of a business carried on as a sole trader or partnership, or to the sale of shares in an unquoted company. Entitlement to ER requires a number of conditions being met for a continuous period of twelve months up to the date when the disposal is made, so early advice should be taken to ensure that the gain qualifies for relief. With effect from 4

December 2014, ER does not apply to the sale of internally generated goodwill on the incorporation of a sole trader or partnership.

Action Point

Entrepreneurs’ Relief rules can easily be broken so if you are disposing of an asset and ER may apply, please seek advice as soon as possible. Some of the conditions need to be met for twelve months prior to the disposal so the earlier you seek advice, the more chance of ER being available.

Determine your Main Residence

The gain on your principal private residence is exempt from CGT. If you have more than one private residence, your ‘main’ residence is, by default, the one you spend more time in. But it is also possible to determine that matter by nominating one of them as your main residence.

This requires careful planning, since the flip side of a gain on one residence being treated as exempt is that a gain on the other residence will become chargeable. Written nominations must be submitted to HMRC within 24 months of any change in residences becoming available.

The main residence exemption is not available on development projects, where a property is acquired with the overriding motive of selling at a profit, particularly where improvement works are carried out.

From April 2015, further restrictions will apply to the ability to nominate your main residence.

These mainly affect non-residents with a UK property, and UK residents with a property abroad.

Proactively manage the challenge of cash

Everyone should keep some of their wealth in cash. After the economic turbulence of recent years, the need to hold some cash has never been clearer. The problem is that many so-called ‘savings’ accounts offer pitifully low interest rates. Others offer a high bonus rate which disappears after six months or a year. Overall, it is extremely difficult and time- consuming to keep your money in competitive accounts. Savers are also concerned about keeping their money safe, covered by a bank deposit guarantee scheme and want to avoid all the paperwork in opening and closing accounts.

The solution:

Use a Cash Management service

A Cash Management service is designed to ensure that:

• Your cash earns consistently competitive interest

• Your cash is secure

• You save time, effort and worry

This is achieved by regularly reviewing the UK savings market and the aim is to select competitive accounts from reputable institutions. Money is moved when rates change and new opportunities arise. Paperwork is arranged and you are kept informed. The difference it makes can be dramatic.

Utilise Individual Savings Accounts (ISAs)

ISAs are an excellent investment for higher rate taxpayers and the maximum allowance for 2014/15 is £15,000. From 2015/16, the income tax exemptions on ISAs will be preserved on death, where one spouse or civil partner leaves it to the other. They remain chargeable to Inheritance Tax (IHT), however.

Pensions

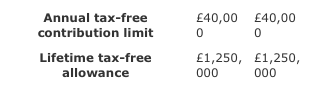

April 2014 saw changes to both the annual and lifetime allowances that apply in respect to your retirement planning. While at first glance, and for various reasons, you may not see this as something that applies to you – think again.

The allowances apply to everyone regardless of the type of arrangements you have, experience to date tells us that the bigger issues lie with members of final salary pension schemes.

Annual allowance

The total you can invest in a suitable pension arrangement each year was reduced by £10,000 on 6 April 2014. If you are planning to maximise payments that you make to your pension payments by carrying forward unused annual allowances from up to 3 previous years, this will also reduce by:

£10,000 in 2014/15

£20,000 in 2015/16

£30,000 in 2016/17

The above figures are subject to your ‘pension input period’ being aligned to the tax year but this may not be the case. If you leave it until the last minute, it may be too late. Should you breach the rules you will be subject to an annual allowance charge. Payment of this charge is the individual plan holder’s responsibility and will be charged at your marginal tax rate.

Lifetime allowance

The amount you can accumulate during your lifetime within your pension plans, without being subject to an additional tax charge, reduced by £250,000 to £1.25 million on 6 April 2014. Where the value of your accumulated funds is above this amount, the lifetime allowance tax charge – currently 55% – will apply.

The rules of your final salary pension scheme dictate its value when calculating both the annual and lifetime allowances. If you plan using a company sponsored money purchase or personal arrangement, the end value is influenced by the growth of your fund as a result of sound investment decisions. In both cases your control is limited.

There are ways to manage the effect that both the annual and lifetime allowance charges may have, however you need to act early.

Consider investing in Enterprise Investment Scheme (EIS) and Seed EIS (SEIS) shares

Tax relief is available where you subscribe for shares qualifying for EIS or SEIS relief.

Under the EIS scheme, your tax liability for the year may be reduced by up to 30% of the sum invested (up to a maximum of £1m invested in the year). In addition, capital gains from disposals in the previous 36 months or following 12 months may be reinvested into EIS shares, resulting in a deferral of the gain.

The Seed EIS scheme offers another form of reinvestment relief for investors who subscribe for shares in small start-up companies. For 2014/15, the maximum qualifying investment is £100,000.

Income tax relief is given at the rate of 50% of the sum invested, and relief may be given against tax in 2014/15 or 2013/14. For investments made in 2014/15, the amount invested may be set against up to half of the gains made in 2013/14, but no offset against 2014/15 gains is available.

Both EIS and Seed EIS shares are normally exempt from CGT and IHT, subject to detailed conditions being met.

A number of professionally managed EIS and SEIS investment funds exist which invest in a broad range of EIS and SEIS companies on behalf of investors, so the tax benefits of EIS and SEIS investments are available to any UK tax payer.

Venture Capital Trusts (VCT)

VCTs are specialist tax incentivised investments that enable individuals to invest indirectly in a range of small higher risk trading companies and securities. VCTs are companies in their own right and, like investment trusts, their shares trade on the London Stock Exchange.

Shares in qualifying VCTs offer the following tax incentives:

Up front income tax relief at 30% of the amount subscribed, subject to a maximum investment of £200,000 per tax year. The investment must be held for a minimum of 5 years in order to retain the income tax relief. Note that income tax relief on the purchase of VCTs is available only where new shares are subscribed, and not to shares acquired from another shareholder.

Dividends received on VCT shares are income tax free (including shares acquired from another holder).

Capital Gains Tax exemption on the VCT shares (including shares acquired from another holder).

Note that gains from other assets cannot be rolled into purchases of VCT shares.

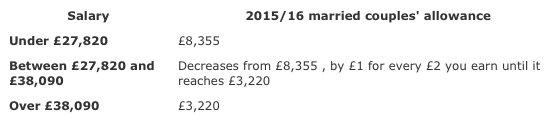

Married Couples and Civil Partnerships

Spouses (and civil partners) may transfer assets from one to the other without any charge to Capital Gains Tax. A higher rate tax payer may therefore transfer shares to a non-tax paying or basic rate tax paying spouse, to make best use of their total income tax allowances and basic rate tax bands.

Where property is owned jointly by a married couple, the property is in most cases deemed to be owned 50:50 for tax purposes. In order to move the income to the lower tax payer, it is necessary first to change the actual ownership proportions (e.g. through a declaration of trust) and then to make a declaration of the actual ownership proportions to HMRC. There are exceptions to this rule, so please check before taking action.

Action Point

Care must be taken as there are rules in place to stop abusive arrangements. There is however possibilities if careful planning is put in place and advice should be sought to ensure any pitfalls are circumvented.

Children

Children are entitled to personal allowances and annual exemptions in the same way as adults. However, there are rules to prevent parents gaining a tax advantage by gifting large sums of money to their children. The income arising from such gifts is taxable on the parent, unless the income is less than £100 in the tax year. Gifts from other relatives, such as grandparents, are not caught by this rule.

Inheritance Tax

Plan for the freeze in Inheritance Tax (IHT) thresholds

The IHT threshold is currently frozen at £325,000 until 5 April 2018. As part of a person’s on-going Inheritance Tax planning, full use should be made of available exemptions. The exemptions are relatively small, but, over time the effect can be substantial:

Annual Exemption – An amount of up to £3,000 can be given away each tax year and, if unused in a year, that amount can be carried forward for one year and utilised in that later year.

Small Gifts Exemption – You can give up to £250 to as many people as you wish each tax year.

Gifts out of Income – If your income regularly exceeds your expenditure, you can give away the excess every year. You do need to record the intention to make these gifts and you do need records of your income and expenditure.

Lifetime Giving – A person may also consider making lifetime gifts in excess of the above exemptions. A person must survive such a gift by seven years for it to fall out of their estates entirely, and the donor must not benefit from the assets once they are gifted. The gifts might be absolute gifts to family members, or they could be gifts into trust. Trusts can be very beneficial, but specialist advice is needed.

IHT Efficient Investments – Another alternative can be to place funds into IHT efficient investments, as such investments can pass free of Inheritance Tax after they have been owned for two years. Appropriate investment advice would be needed when considering such planning.

Action Point

There are possibilities to ensure estates are reduced during one’s lifetime to prevent a large

IHT liability on death. As part of the planning, your advisor would need to consider all sources of wealth and take into account many other factors. Early action can often lead to a large part of one’s estate being shielded from IHT.

Charitable Giving

If a higher rate or additional rate taxpayer makes a Gift Aid donation, further tax relief is available to the donor over and above the tax relief claimed by the charity.

A Gift Aid donation of £80 is worth £100 to the charity. A higher rate taxpayer will qualify for further tax relief of £20 so that the net cost of the donation is only £60. For an additional rate taxpayer, the further tax relief is worth £25, so that the net cost of the donation is only £55.

You should keep a record of Gift Aid donations made in the year and this can include sponsorship.

Finally please remember that if you are not a UK taxpayer, you cannot make Gift Aid donations.

Pensions

In his March 2014 Budget, Chancellor George Osborne introduced “the most radical changes to pensions in almost a century”. The new measures come with extensive implications for an estimated 18 million people in the UK who have pension plans. It has been estimated that as many as ‘one in eight’ pensioners may seek to withdraw all the funds in their pension. In his speech, George Osborne clearly underlined the need for expert advice whatever your stage of life in order to benefit from the changes and ultimately enjoy a comfortable retirement. It should be noted that as the median pension pot is around £12,500, the advice which will be freely available to the average person will be necessarily limited.

Background

Traditionally, those retiring with their own pension funds purchased annuities. However, returns had been falling dramatically over the last few years. This was due partly to the rise in life expectancy but more recently because of the lowering of interest rates during the recession. Those with larger pension funds had more options, such as flexible drawdown, but restrictions still applied. The common belief was that change was overdue.

Some things have not changed in that there are still restrictions on how much you can save both in each year and over your lifetime – this rule must never be forgotten!

Changes

Some changes have already come into effect. The limits on how much people can draw each year have been relaxed since March 2014. To access flexible drawdown, you need to have a secured annual income of £12,000 (previously £20,000). This requirement will be abolished altogether from April 2015. From April 2015, the following changes will come into effect…

Flexible access from age 55

Pension investors aged at least 55 (rising to 57 from 2028) will be able to access their pension fund as a lump sum if they wish. The first 25% will be tax free and the rest will be treated as taxable income and will be subject to income tax at their marginal income tax rate.

Basic-rate tax payers need to be aware that any income drawn from their pension will be added to any other income received, which could result in them paying tax at 40% or even 45%.

You can also choose to take your pension in smaller lump sums, spread over time, to help manage your tax liability.

Action Point

If you are in a Defined Contribution scheme (“DC”or Money Purchase), you should consider your options now.

Income drawdown restrictions to be relaxed

Those with larger pension pots have the ability to draw an income directly from their fund.

Using income drawdown means you can choose how much income to take and when, which, leaves your options open. The rest of the fund remains invested and gives your money the opportunity for further growth. From April 2015, some current restrictions will be removed. Fully flexible drawdown will offer considerable freedom but highlights the need for expert planning advice. Capped drawdown arrangements will continue, though are currently limited to 150% of a benchmark annuity rate. It should be noted that adopting these new flexibilities will restrict your future ability to invest more into your pension scheme – care is necessary!

Action point

If you are already in flexible drawdown prior to 6 April 2015, you can move to the new unlimited regime and draw more income than the current maximum.

Transferring a final salary scheme

If you have a final salary (e.g. Defined Benefit (“DB”)) pension fund, you may still be able to take advantage of the new rules to make unlimited withdrawals. However to do so, you would have to transfer some or all of your pension into a DC pension, such as a Self Invested Personal Pension (SIPP). You should seek financial advice before transferring benefits, as you could lose valuable benefits which need to be weighed against the new flexibilities.

Unfortunately, members of unfunded public sector Defined Benefit schemes, such as the NHS Superannuation scheme won’t be able to transfer to Defined Contribution schemes.

Action point

Speaking to an adviser before transferring benefits out of a Defined Benefit scheme will ensure you are aware of the full implications.

Reviewing your retirement plans

The new rules give considerable freedom of choice. Under the new rules, whilst nobody will be forced to buy an annuity at any age, those who wish to can do so at present and this may prove to remain the best answer for some people.

Clearly, it has never been more important to make the right choices about your pension fund both about how should you carry on saving as much as how you should take the benefits. These decisions will affect you for the rest of your life. It is essential, especially for those nearing retirement, to seek professional advice. Not only will an expert look at your pension fund, but they will consider your wider financial goals.

What’s more, Andrew’s many years of experience means that there are few situations that he has not encountered meaning the advice he offers is based on a working knowledge not text book learning.

What’s more, Andrew’s many years of experience means that there are few situations that he has not encountered meaning the advice he offers is based on a working knowledge not text book learning.