Tax Rates 2015/16 - Break down what the taxman gets!

Nothing’s as certain as death and taxes. Yet while there’s no doubt we’ll all be taxed, the rates can change rapidly. Will you pay 20% or will you end up in the 40% tax bracket?

This is an updated guide for the tax years starting 6 April 2015.

In this guide…

What income tax rate will I pay?

What’s my personal allowance?

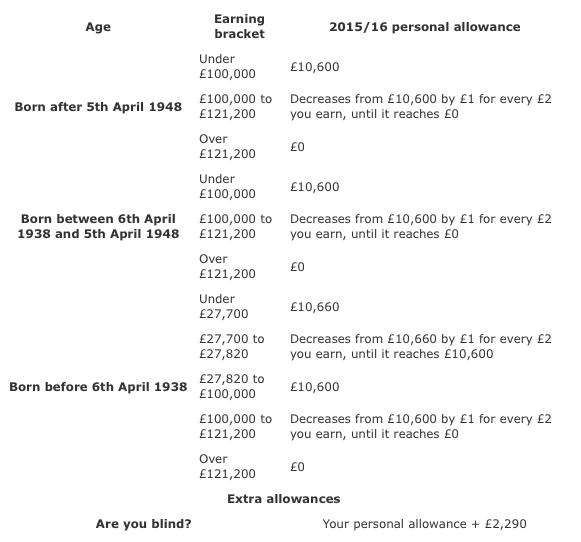

Each of us has a ‘personal allowance’, which denotes the amount we can earn without paying any income tax. If you earn more than your personal allowance, then you pay tax at the applicable rate on all earnings

above the personal allowance, but the allowance remains untaxed. Your specific personal allowance depends on your age and, in some cases, your salary.

What’s my 2015/16 personal allowance?

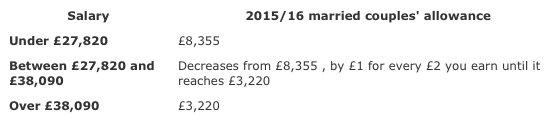

If you are married, and one partner was born before 6 April 1935, then you get an extra married couples’ allowance.

10% of this allowance is then subtracted from your annual income tax. If you were married before 5 December 2005, it is automatically worked out using the husband’s salary. For couples married on or after 5 December 2005, it uses the highest earner’s salary.

Born 6 April 1935 or before – married couples’ allowance 2015/16?

Once you know your allowance, work out 10% of it. You will receive this amount in tax relief.

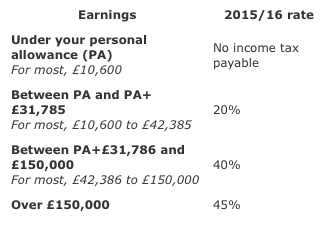

What income tax band am I in?

Once you know your personal allowance, anything extra earned will be subject to income tax. For the 2015/16 tax year, there are three marginal income tax bands, including the 40% tax bracket and the 45% ‘additional rate’ bracket (also remember your personal allowance starts to shrink once earnings hit £100,000).

What is my income tax rate 2015/16?

Marginal bands mean you only pay the specified tax rate on that portion of salary. For instance, if your salary puts you in the 40% tax bracket (over PA+£31,785 in 2015/16), then you only pay 40% tax on the segment of earnings in that income tax band. For the lower part of your earnings, you’ll still pay the appropriate 20% or 0%.

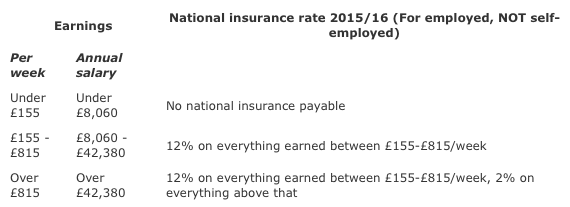

What’s national insurance?

In addition to plain old income tax, most UK workers also have national insurance contributions deducted from their pay. These kick in based on your earnings from the age of 16, and you stop paying when you reach state retirement age.

What’s my national insurance rate 2015/16?

Some advanced national insurance rules, particularly for the self-employed, are very complicated. See the HMRC website for full rates.

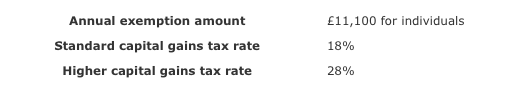

Capital gains tax

Capital gains is the least common tax on income, and for many it won’t apply. However, if you sell or give away an asset worth more than £6,000, you could have to pay CGT. It doesn’t apply for main homes, cars or lottery/pools winnings, among other things.

Each year, individuals have an annual exemption amount that allows them to receive some gains tax-free. Above this, you pay capital gains tax on all gains.

Capital gains tax in 2015/16

Your rate of capital gains tax will depend on your other taxable income. See the HMRC websitefor more on how to work this out.

Paying into a pension?

Pension payments get very complex indeed, yet the basic thing to remember is that most people don’t have to pay tax on the money they pay into their pension via their employer’s PAYE system. Instead, the tax relief is used to top up your pension contributions.

If you aren’t a taxpayer, then you’ll be given an extra £20 for every £80 you pay into a pension up until you’ve contributed £2,880. This means the Government tops up your pension to £3,600.

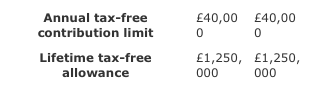

However, there are some limits on the amount of tax-free contributions you can make (both in a year and over your lifetime).

Pension contribution limits 2014/15 & 2015/16

If you use the new pension freedoms to access your pension pot, then your annual allowance will drop to £10,000 for that year.

What’s more, Andrew’s many years of experience means that there are few situations that he has not encountered meaning the advice he offers is based on a working knowledge not text book learning.

What’s more, Andrew’s many years of experience means that there are few situations that he has not encountered meaning the advice he offers is based on a working knowledge not text book learning.